12 分钟

策展

策展人对The Graph的去中心化经济至关重要。他们利用他们对web3生态系统的了解来评估和标记应该由The Graph网络索引的子图。通过Graph浏览器,策展人查看网络数据以做出标记决策。反过来,The Graph网络会奖励那些在高质量子图上发出信号的策展人,并分享这些子图产生的查询费用。GRT信号量是索引人在确定索引哪些子图时的关键考虑因素之一。

信号对The Graph 网络意味着什么?

在消费者可以查询子图之前,必须对其进行索引。这就是策展发挥作用的地方。为了使索引人在高质量的子图上获得可观的查询费用,他们需要知道要索引哪些子图。当策展人在子图上发出信号时,它会让索引人知道一个子图有需求,并且质量足够高,应该被索引。

策展人使The Graph网络高效,而信号 是策展人用来让索引人知道子图适合索引的过程。索引人可以信任策展人的信号,因为策展人根据信号为子图创建策展份额,使他们有权获得子图驱动的未来查询费用的一部分。

策展人信号表示为ERC20代币,称为Graph策展份额(GCS)。那些想获得更多查询费的人应该向他们预测将产生大量费用流入网络的子图发出GRT信号。不能因为不良行为而削减策展人,但对策展人征收押金税,以抑制可能损害网络完整性的不良决策。如果策展人在低质量的子图上进行策展,他们也会获得更少的查询费,因为需要处理的查询或需要处理的索引人会更少。

Sunrise 升级索引人 确保对所有子图进行索引,表明特定子图上的GRT将吸引更多的索引人。通过策展来激励额外的索引人,旨在通过减少延迟和提高网络可用性来提高查询的服务质量。

在发出信号时,策展人可以决定在子图的特定版本上发出信号,或者使用自动迁移发出信号。如果他们使用自动迁移发出信号,策展人的份额将始终更新到开发人员发布的最新版本。如果他们决定在特定版本上发出信号,则共享将始终保留在该特定版本上。

如果您需要协助策展以提高服务质量,请向Edge & Node团队发送请求,网址为[email protected]并指定需要帮助的子图。

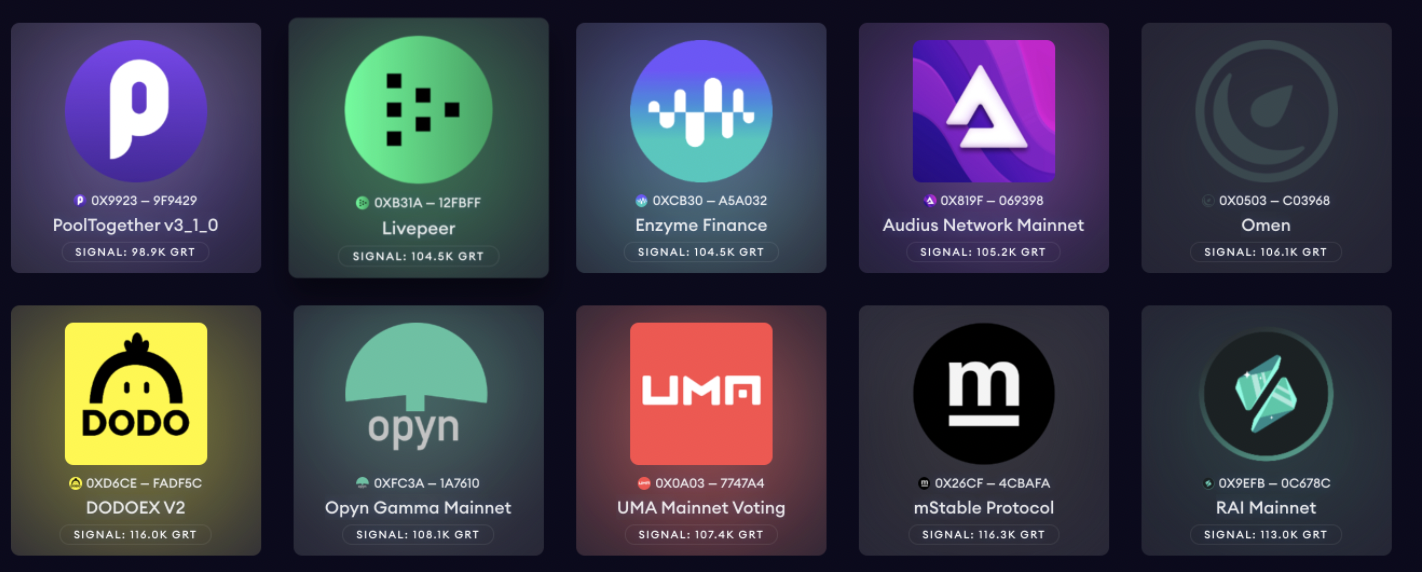

索引人可以根据他们在Graph 浏览器中看到的策展信号找到要索引的子图(下面的截图)。

如何进行信号处理

在Graph 浏览器的策展人选项卡中,策展人将能够根据网络统计数据对某些子图发出信号和取消信号。 关于如何在浏览器中做到这一点的一步步概述,请点击这里。

策展人可以选择在特定的子图版本上发出信号,或者他们可以选择让他们的策展份额自动迁移到该子图的最新生产版本。 这两种策略都是有效的,都有各自的优点和缺点。

当一个子图被多个 dapp 使用时,在特定版本上发出信号特别有用。 一个 dapp 可能需要定期更新子图的新特性。 另一个 dapp 可能更喜欢使用更旧的、经过良好测试的子图版本。 在初始策展时,会产生 1%的标准税。

让你的策展份额自动迁移到最新的生产构建,对确保你不断累积查询费用是有价值的。 每次你策展时,都会产生 1%的策展税。 每次迁移时,你也将支付 0.5%的策展税。 不鼓励子图开发人员频繁发布新版本—他们必须为所有自动迁移的策展份额支付 0.5%的策展税。

注意: 第一个给特定子图发出信号的地址被认为是第一个策展人,将不得不消耗比之后其他策展人更多的燃气费工作,因为第一个策展人初始化了策展份额代币,还将代币转移到 The Graph 代理。

撤回您的GRT

策展人有权随时撤回他们发出的GRT信号。

与委托过程不同,如果您决定撤回您的信号GRT,您将不必等待冷却期,并将收到全部金额(减去1%的策展税)。

一旦策展人撤回他们的信号,索引人可能会选择继续对子图进行索引,即使目前没有活动的GRT信号。

然而,建议策展人保留他们的信号GRT,不仅可以获得部分查询费用,还可以确保子图的可靠性和正常运行时间。

风险

- 在The Graph,查询市场本来就很年轻,由于市场动态刚刚开始,你的年收益率可能低于你的预期,这是有风险的。

- 策展费 - 当策展人对子图发出 GRT 信号时,他们会产生 1%的策展税。这笔费用被消耗掉了。

- 当策展人消耗他们的股份以提取 GRT 时,剩余股份的 GRT 估值将被降低。(仅适用于以太坊) 请注意,在某些情况下,策展人可能决定一次性消耗他们的份额。 这种情况可能很常见,如果一个 dApp 开发者停止版本/改进和查询他们的子图,或者如果一个子图失败。 因此,剩下的策展人可能只能提取他们最初 GRT 的一小部分。 关于风险较低的网络角色,请看 委托人。

- 一个子图可能由于错误而失败。 一个失败的子图不会累积查询费用。 因此,你必须等待,直到开发人员修复错误并部署一个新的版本。

- 如果你订阅了一个子图的最新版本,你的份额将自动迁移到该新版本。 这将产生 0.5%的策展税。

- 如果你已经在一个特定的子图版本上发出信号,但它失败了,你将不得不手动花费你的策展份额。 然后你可以在新的子图版本上发出信号,从而产生 1%的策展税。

策展常见问题

1. 策展人能赚取多少百分比的查询费?

通过在一个子图上发出信号,你将获得这个子图产生的所有查询费用的份额。 所有查询费用的 10%将按策展人的策展份额比例分配给他们。 这 10%是受管理的。

2. 如何决定哪些子图是高质量的信号?

寻找高质量的子图是一项复杂的任务,但它可以通过许多不同的方式来实现。 作为策展人,你要寻找那些推动查询量的值得信赖的子图。 这些值得信赖的子图是有价值的,因为它们是完整的,准确的,并支持 dapp 的数据需求。 一个架构不良的子图可能需要修改或重新发布,也可能最终失败。 策展人审查子图的架构或代码,以评估一个子图是否有价值,这是至关重要的。 因此:

- 策展人可以利用网络知识,尝试预测单个子图在未来可能产生更多或更少查询量。

- 策展人还应该了解通过 Graph 浏览器提供的指标。 像过去的查询量和子图开发者是谁这样的指标可以帮助确定一个子图是否值得发出信号。

3. 升级一个子图的成本是多少?

将你的策展份额迁移到一个新的子图版本会产生 1%的策展税。 策展人可以选择订阅子图的最新版本。 当策展人质押被自动迁移到一个新的版本时,策展人也将支付一半的策展税,即 0.5%,因为升级子图是一个链上动作,需要花费交易费。

4. 多长时间可以升级子图?

建议你不要太频繁地升级子图。 更多细节请见上面的问题。

5. 我可以出售我的策展份额吗?

策展股份不能像您可能熟悉的其他ERC20代币那样“买入”或“卖出”。它们只能被铸造(创造)或焚烧(销毁)。

在Arbitrum上作为策展人,您可以保证收回最初存入的GRT(减去税款)。

6.我有资格获得策展资助吗?

策展资助根据具体情况单独确定。如果您需要策展方面的帮助,请发送请求至[email protected].。

还有困惑吗? 点击下面查看策展视频指导: