7 minutes

Curating

Curators are critical to The Graph’s decentralized economy. They use their knowledge of the web3 ecosystem to assess and signal on the Subgraphs that should be indexed by The Graph Network. Through Graph Explorer, Curators view network data to make signaling decisions. In turn, The Graph Network rewards Curators who signal on good quality Subgraphs with a share of the query fees those Subgraphs generate. The amount of GRT signaled is one of the key considerations for indexers when determining which Subgraphs to index.

What Does Signaling Mean for The Graph Network?

Before consumers can query a Subgraph, it must be indexed. This is where curation comes into play. In order for Indexers to earn substantial query fees on quality Subgraphs, they need to know what Subgraphs to index. When Curators signal on a Subgraph, it lets Indexers know that a Subgraph is in demand and of sufficient quality that it should be indexed.

Curators make The Graph network efficient and signaling is the process that Curators use to let Indexers know that a Subgraph is good to index. Indexers can trust the signal from a Curator because upon signaling, Curators mint a curation share for the Subgraph, entitling them to a portion of future query fees that the Subgraph drives.

Curator signals are represented as ERC20 tokens called Graph Curation Shares (GCS). Those that want to earn more query fees should signal their GRT to Subgraphs that they predict will generate a strong flow of fees to the network. Curators cannot be slashed for bad behavior, but there is a deposit tax on Curators to disincentivize poor decision-making that could harm the integrity of the network. Curators will also earn fewer query fees if they curate on a low-quality Subgraph because there will be fewer queries to process or fewer Indexers to process them.

The Sunrise Upgrade Indexer ensures the indexing of all Subgraphs, signaling GRT on a particular Subgraph will draw more indexers to it. This incentivization of additional Indexers through curation aims to enhance the quality of service for queries by reducing latency and enhancing network availability.

When signaling, Curators can decide to signal on a specific version of the Subgraph or to signal using auto-migrate. If they signal using auto-migrate, a curator’s shares will always be updated to the latest version published by the developer. If they decide to signal on a specific version instead, shares will always stay on this specific version.

If you require assistance with curation to enhance the quality of service, please send a request to the Edge & Node team at support@thegraph.zendesk.com and specify the Subgraphs you need assistance with.

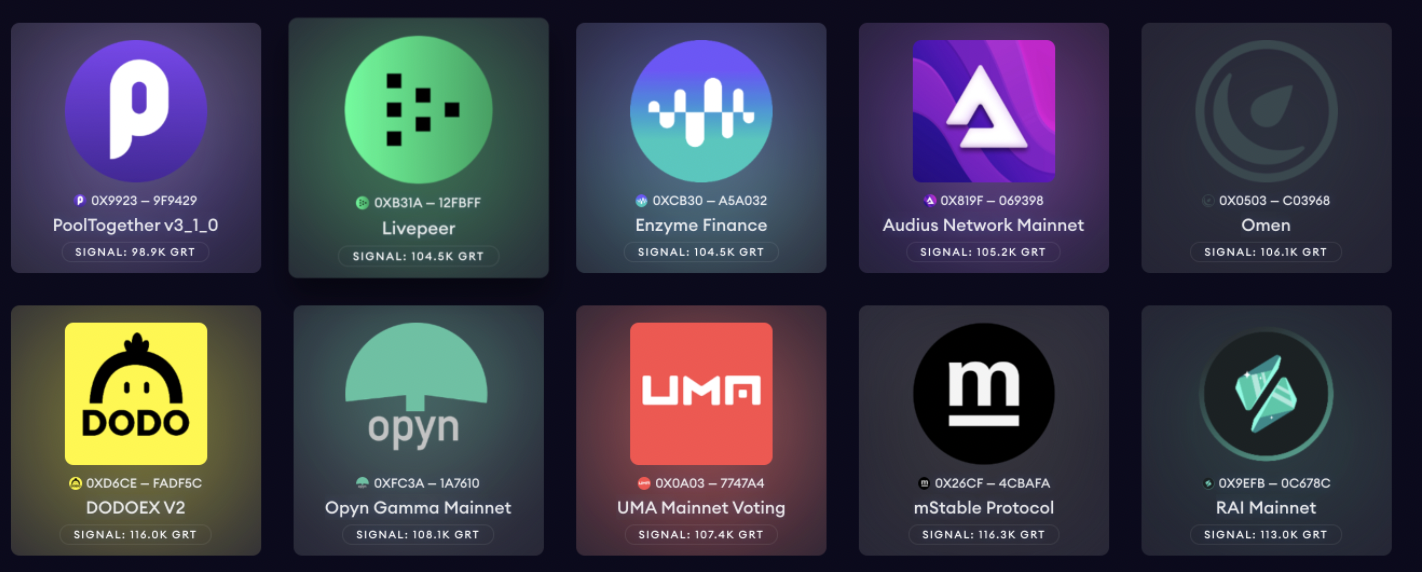

Indexers can find Subgraphs to index based on curation signals they see in Graph Explorer (screenshot below).

How to Signal

Within the Curator tab in Graph Explorer, curators will be able to signal and unsignal on certain Subgraphs based on network stats. For a step-by-step overview of how to do this in Graph Explorer, click here.

A curator can choose to signal on a specific Subgraph version, or they can choose to have their signal automatically migrate to the newest production build of that Subgraph. Both are valid strategies and come with their own pros and cons.

Signaling on a specific version is especially useful when one Subgraph is used by multiple dapps. One dapp might need to regularly update the Subgraph with new features. Another dapp might prefer to use an older, well-tested Subgraph version. Upon initial curation, a 1% standard tax is incurred.

Having your signal automatically migrate to the newest production build can be valuable to ensure you keep accruing query fees. Every time you curate, a 1% curation tax is incurred. You will also pay a 0.5% curation tax on every migration. Subgraph developers are discouraged from frequently publishing new versions - they have to pay a 0.5% curation tax on all auto-migrated curation shares.

Note: The first address to signal a particular Subgraph is considered the first curator and will have to do much more gas-intensive work than the rest of the following curators because the first curator initializes the curation share tokens, and also transfers tokens into The Graph proxy.

Withdrawing your GRT

Curators have the option to withdraw their signaled GRT at any time.

Unlike the process of delegating, if you decide to withdraw your signaled GRT you will not have to wait for a cooldown period and will receive the entire amount (minus the 1% curation tax).

Once a curator withdraws their signal, indexers may choose to keep indexing the Subgraph, even if there’s currently no active GRT signaled.

However, it is recommended that curators leave their signaled GRT in place not only to receive a portion of the query fees, but also to ensure reliability and uptime of the Subgraph.

Risks

- The query market is inherently young at The Graph and there is risk that your %APY may be lower than you expect due to nascent market dynamics.

- Curation Fee - when a curator signals GRT on a Subgraph, they incur a 1% curation tax. This fee is burned.

- (Ethereum only) When curators burn their shares to withdraw GRT, the GRT valuation of the remaining shares will be reduced. Be aware that in some cases, curators may decide to burn their shares all at once. This situation may be common if a dapp developer stops versioning/improving and querying their Subgraph or if a Subgraph fails. As a result, remaining curators might only be able to withdraw a fraction of their initial GRT. For a network role with a lower risk profile, see Delegators.

- A Subgraph can fail due to a bug. A failed Subgraph does not accrue query fees. As a result, you’ll have to wait until the developer fixes the bug and deploys a new version.

- If you are subscribed to the newest version of a Subgraph, your shares will auto-migrate to that new version. This will incur a 0.5% curation tax.

- If you have signaled on a specific Subgraph version and it fails, you will have to manually burn your curation shares. You can then signal on the new Subgraph version, thus incurring a 1% curation tax.

Curation FAQs

1. What % of query fees do Curators earn?

By signalling on a Subgraph, you will earn a share of all the query fees that the Subgraph generates. 10% of all query fees go to the Curators pro-rata to their curation shares. This 10% is subject to governance.

2. How do I decide which Subgraphs are high quality to signal on?

Finding high-quality Subgraphs is a complex task, but it can be approached in many different ways. As a Curator, you want to look for trustworthy Subgraphs that are driving query volume. A trustworthy Subgraph may be valuable if it is complete, accurate, and supports a dapp’s data needs. A poorly architected Subgraph might need to be revised or re-published, and can also end up failing. It is critical for Curators to review a Subgraph’s architecture or code in order to assess if a Subgraph is valuable. As a result:

- Curators can use their understanding of a network to try and predict how an individual Subgraph may generate a higher or lower query volume in the future

- Curators should also understand the metrics that are available through Graph Explorer. Metrics like past query volume and who the Subgraph developer is can help determine whether or not a Subgraph is worth signalling on.

3. What’s the cost of updating a Subgraph?

Migrating your curation shares to a new Subgraph version incurs a curation tax of 1%. Curators can choose to subscribe to the newest version of a Subgraph. When curator shares get auto-migrated to a new version, Curators will also pay half curation tax, ie. 0.5%, because upgrading Subgraphs is an onchain action that costs gas.

4. How often can I update my Subgraph?

It’s suggested that you don’t update your Subgraphs too frequently. See the question above for more details.

5. Can I sell my curation shares?

Curation shares cannot be “bought” or “sold” like other ERC20 tokens that you may be familiar with. They can only be minted (created) or burned (destroyed).

As a Curator on Arbitrum, you are guaranteed to get back the GRT you initially deposited (minus the tax).

6. Am I eligible for a curation grant?

Curation grants are determined individually on a case-by-case basis. If you need assistance with curation, please send a request to support@thegraph.zendesk.com.

Still confused? Check out our Curation video guide below: