1 Billion Monthly Queries

June was an explosive month for Ethereum.

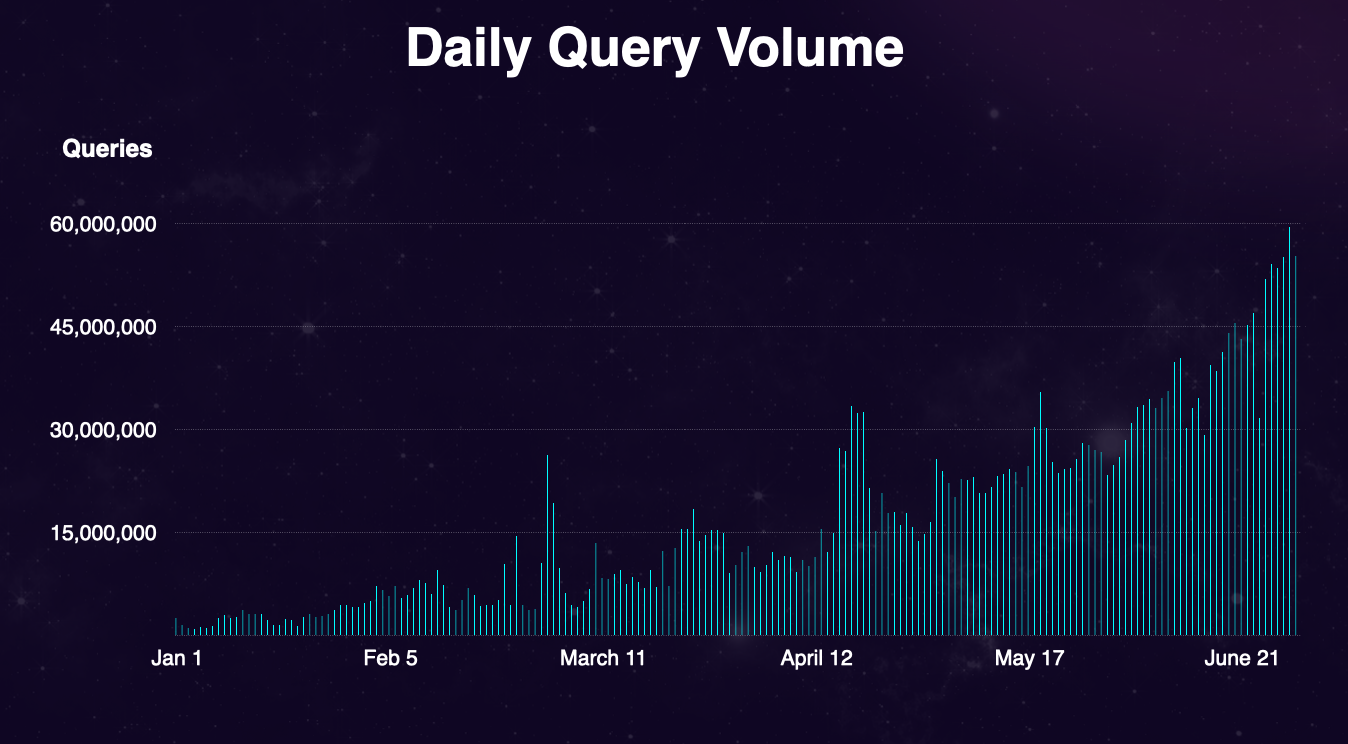

Typical daily query volume on Hosted Service has been 20M to 30M over the past few months, but in June that doubled to 40M to 60M daily queries. With over 1,600 subgraphs deployed, The Graph processed over 1 billion queries in June 2020!

1 billion, 1 bilsky, a billi

Hitting 1 billion monthly queries is a huge milestone, not only for the team building The Graph, but for the wider Ethereum and Web3 communities. It signifies that dApp adoption is accelerating, and that it’s becoming consistent. Since January 2020, month-over-month (MoM) query volume growth has consistently been greater than 50% with May to June seeing 59% growth.

The rate of subgraph development and new users has also remained steady, maintaining 7-12% MoM growth rate for over 9 months. This shows that query volume is growing faster than subgraph development - in other words, Ethereum usage is growing ~5x faster than Ethereum developer activity.

So where is this usage coming from?

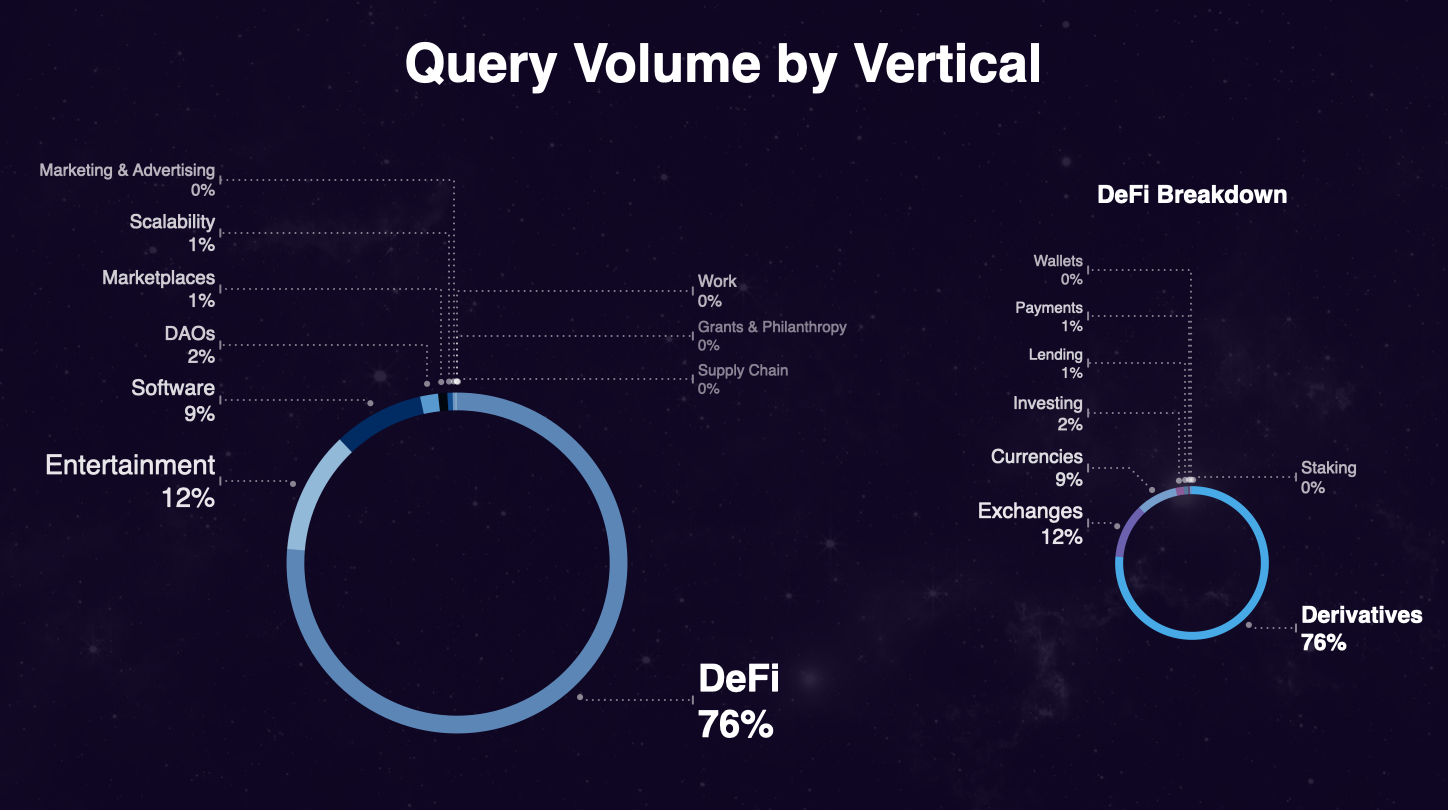

Currently DeFi makes up 76% of total query volume (all-time), however there has been growing diversification in usage. Entertainment applications such as arts and collectibles and gaming now make up 12% of total volume, while they only made up 5% of volume 3 months ago. Software computing platforms, DAOs and marketplaces are also highly popular.

Note: while there is a large distribution of applications that are using The Graph today, these statistics are not reflective of activity in the entire ecosystem.

DeFi Domination

Subgraphs are powering most DeFi applications, including Synthetix, Uniswap, Gnosis, Balancer, Aave, Opyn, 1inch Exchange, Rainbow Wallet and more! While DeFi makes up 76% of current volume, in June alone, DeFi made up over 85% of volume. Within DeFi, Derivatives applications make up most of the pie, however decentralized exchanges and currency bridges are also seeing high usage.

Diving deeper, in June there were several new dApp launches and distribution of new DeFi governance tokens. The effect of this is twofold:

- Increased dApp usage can increase query volume to specific subgraphs

- Growth in liquidity, trading volume and new token holders has spillover effects across dApps, like exchanges. This is the beauty of open and permissionless protocols, applications can build on the success of other applications.

Since subgraphs are open APIs they don’t need to be built by the native smart contract developers and they can be used by anyone. Some of the most interesting use cases for subgraphs in DeFi are data aggregators, banking app aggregators, wallets, registries and marketplaces.

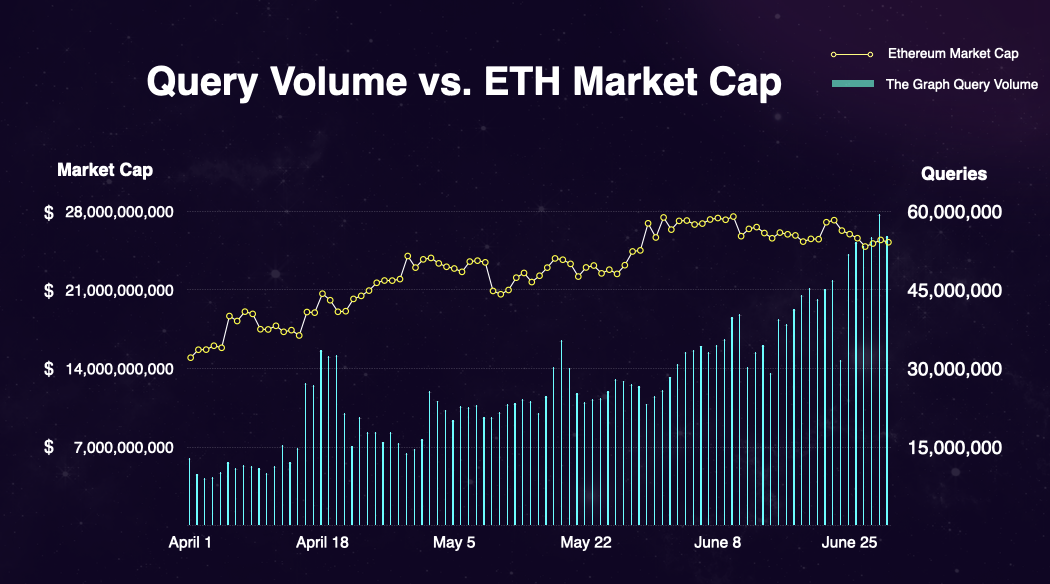

To further understand the potential impact that crypto market fluctuations can have on subgraph query volume, I conducted a regression to see whether total query volume is correlated with ETH market cap.

The analysis shows that over the last 3 months, the correlation coefficient (multiple r) is 0.71, implying a high correlation between query volume and ETH market activity (the closer to 1.0 the more linear the correlation). The percentage change in query volume that can be attributed to the market is 51% (r2= 0.51). The p-value is also < 0.0001, indicating these results are non-trivial.

A regression where ETH Market Cap is now the dependent variable also shows a correlation, with a coefficient of 0.65. This is exciting news, it means that Ethereum is increasingly becoming fundamentals-driven, with the market valuation being closely coupled to usage metrics. We can also extract that ETH volatility and overall dApp usage are self-reinforcing - see the shared spikes and slopes above (eg. April 18th, around May 5th).

To infinity and beyond!

The opportunities are endless with subgraphs. Any on-chain event and call data can be indexed by a subgraph and queried by a front-end application; data like trade volumes, asset prices, voting results. Even cooler is that the application doesn’t even have to interact with a blockchain to query a subgraph, thus reducing the barrier to entry for new developers.

Queries are currently processed on the Hosted Service, yet it’s critical that applications are confident in their ability to stay up and serve their users. As a result we are working hard to bring the decentralized Graph Network to the world so serverless applications can be made possible and so members of the community can be rewarded for contributing data indexing services.

As we head into network launch, we expect Ethereum dApp usage will continue to accelerate and subgraph query volume to follow. We’re excited to see the ecosystem grow and will continue to support development in Ethereum and the broader Web3 community with multi-blockchain support coming later this year.

About The Graph

is the leading indexing and query protocol powering the decentralized internet. Since launching in 2018, it has empowered tens of thousands of developers to effortlessly build and leverage across countless blockchains, including Ethereum, Solana, Arbitrum, Optimism, Base, Polygon, Celo, Soneium, and Avalanche. With powerful tools like Substreams and Token API, The Graph delivers high-performance, real-time access to onchain data. From low-latency indexing to rapid token data, it serves as the premier solution for building composable, data drive dapps.

Discover more about how The Graph is shaping the future of decentralized physical infrastructure networks (DePIN) and stay connected with the community. Follow The Graph on , , , , , and . Join the community on The Graph’s , join technical discussions on The Graph’s .